Featured

Table of Contents

- – The Expanding Need for Financial Debt Forgiven...

- – Bankruptcy Counseling: The Misunderstood Safeg...

- – Comparing Your Debt Alleviation Options

- – What Establishes Nonprofit Therapy Apart

- – Indication of Predatory Financial Obligation R...

- – Taking the Initial Step Toward Recuperation

- – The Path Forward

Economic anxiety has come to be a defining feature of contemporary American life. With overall credit score card debt surpassing $1.21 trillion and the average cardholder owing even more than $6,500, numerous people discover themselves caught in cycles of minimum repayments and compounding interest. When charge card passion rates float around 23%, even modest balances can swell right into frustrating concerns within months.

For those sinking in the red, the concern isn't whether to look for assistance-- it's discovering the best sort of aid that won't make matters worse.

The Expanding Need for Financial Debt Forgiveness Solutions

Financial debt forgiveness has arised as among one of the most browsed monetary subjects on-line, and forever factor. The principle of clearing up financial debts for much less than the sum total owed offers real want to people that see no reasonable path to paying their balances completely.

The procedure normally works like this: when charge card accounts go unpaid for 120 days or even more, creditors often charge off the financial obligation. At this phase, they may accept minimized negotiations to recuperate at the very least a part of what's owed. Successful negotiations can reduce balances by 30% to 50%, depending upon the lender and your demonstrated financial challenge.

Financial debt forgiveness isn't cost-free cash. Settled accounts show up on credit reports as "" paid less than complete equilibrium,"" which influences your rating. In addition, forgiven quantities surpassing $600 might be reported to the IRS as gross income. Comprehending these trade-offs prior to pursuing negotiation is important.

Bankruptcy Counseling: The Misunderstood Safeguard

Insolvency brings considerable stigma, yet it stays a reputable lawful device designed to give overwhelmed individuals a genuine new beginning. What lots of individuals don't know is that federal law calls for 2 counseling sessions prior to and after declaring-- and these sessions exist specifically to guarantee you're making an informed choice.

Pre-bankruptcy credit history therapy entails a thorough evaluation of your income, financial debts, and expenditures. Certified counselors existing options you could not have actually taken into consideration, including debt administration programs or hardship negotiations. This isn't regarding inhibiting insolvency; it's regarding confirming it's really your best option.

Post-bankruptcy borrower education and learning prepares you for financial success after discharge. You'll find out budgeting techniques, saving strategies, and credit report rebuilding comes close to developed to avoid future financial troubles.

Organisations like APFSC offer both called for programs, with charges around $19.99 per session unless you receive challenge waivers. Their certified therapists give same-day certificates, and sessions commonly run 60 to 90 mins. This access issues when you're already emphasized regarding funds.

Comparing Your Debt Alleviation Options

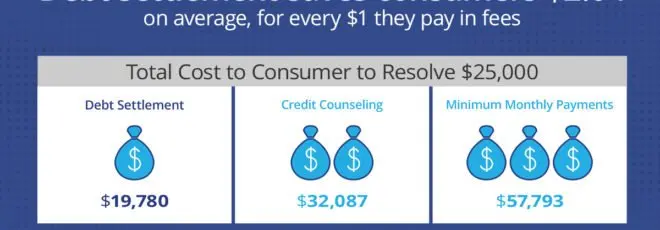

Recognizing the landscape of financial debt alleviation helps you make educated choices. Each technique lugs distinctive benefits and downsides.

Financial Debt Monitoring Programs combine numerous unsecured debts into single monthly payments. Counselors discuss with creditors to potentially reduce rates of interest without calling for new car loans. Many clients total these programs within three to five years. The key advantage is paying debts completely while decreasing complete interest paid.

Debt Settlement negotiates reduced benefit amounts, normally 30% to 50% much less than owed. This strategy needs stopping repayments to creditors while building up negotiation funds, which damages credit score ratings throughout the procedure. Outcomes differ based upon financial institution determination and your shown hardship.

Personal bankruptcy supplies court defense while getting rid of or reorganizing financial debts. Chapter 7 liquidates certain possessions to discharge unsecured financial obligations quickly. Chapter 13 establishes three-to-five-year repayment plans for those with regular revenue. Bankruptcy stays on credit score reports for seven to 10 years yet offers one of the most comprehensive clean slate.

Credit report Therapy gives education and learning and assistance without necessarily registering in formal programs. Licensed therapists assess your complete monetary picture and suggest suitable following actions, which may consist of any one of the above alternatives.

What Establishes Nonprofit Therapy Apart

The difference in between nonprofit and for-profit financial debt alleviation companies matters tremendously. Not-for-profit companies like those certified by the National Foundation for Credit Scores Counseling (NFCC) run under strict ethical guidelines and fee laws. Their therapists undertake strenuous qualification and needs to recertify every two years.

For-profit financial debt settlement firms, alternatively, may charge costs varying from 15% to 25% of signed up financial debt equilibriums. Some employ hostile sales tactics and make unrealistic pledges regarding outcomes. The Customer Financial Defense Bureau has recorded countless complaints regarding predative methods in this market.

APFSC operates as a not-for-profit counseling company, offering totally free financial debt administration assessments and managed costs for continuous services. Their HUD-approved real estate therapists add value for those encountering foreclosure together with basic financial obligation worries. Solutions are available in English, Spanish, and Portuguese, expanding accessibility to underserved areas.

Study sustains the performance of not-for-profit counseling. A research appointed by the NFCC discovered that debt counseling clients lowered revolving debt by $3,600 greater than contrast teams during the 18 months following their sessions. Nearly 70% of individuals reported improved cash administration and better monetary confidence.

Indication of Predatory Financial Obligation Relief Provider

Not all financial debt relief companies have your ideal interests in mind. Identifying warnings safeguards you from making a tight spot worse.

Beware of companies that assure certain results. No genuine solution can guarantee exact settlement portions or timeline guarantees due to the fact that outcomes rely on private creditors and situations.

Stay clear of any kind of company demanding huge in advance fees prior to supplying services. Genuine nonprofit therapy supplies totally free preliminary examinations, and for-profit negotiation companies are legitimately restricted from accumulating charges till they efficiently work out at the very least one debt.

Question anyone suggesting you to stop connecting with lenders completely without explaining the repercussions. While critical interaction stops briefly occasionally sustain negotiations, full evasion can cause lawsuits, wage garnishment, and additional damages.

Genuine companies discuss all choices honestly, consisting of alternatives that might not include their paid solutions. If a company pushes just one solution despite your situation, seek advice in other places.

Taking the Initial Step Toward Recuperation

Financial recovery starts with straightforward assessment. Collect your latest declarations for all financial obligations, compute your total responsibilities, and evaluate your reasonable regular monthly repayment capability. This details develops the foundation for any type of productive therapy session.

Consider scheduling free examinations with multiple not-for-profit companies before dedicating to any kind of program. Compare their recommendations, fee frameworks, and interaction styles. The right counseling relationship need to really feel encouraging instead than pushing.

Organisations like APFSC use online chat, phone assessments, and detailed intake procedures developed to recognize your distinct situation before advising solutions. Their debt management calculator aids you imagine prospective timelines and financial savings prior to registering.

The Path Forward

Frustrating financial obligation doesn't define your future-- however neglecting it will. Whether debt forgiveness, bankruptcy counseling, or structured financial debt management makes feeling for your situation relies on factors special to your conditions.

Professional assistance from certified not-for-profit counselors illuminates alternatives you could never uncover separately. These services exist especially to aid people like you navigate complex financial obstacles without predacious costs or impractical pledges.

The average American battling with debt waits much also lengthy before seeking aid, permitting rate of interest to compound and options to slim. On a monthly basis of delay prices money and expands your recuperation timeline.

Housing Counseling for People with Non-Traditional Income (Gig Workers and Contractors)Your initial discussion with a certified therapist costs absolutely nothing yet can alter whatever. Financial freedom isn't reserved for the lucky-- it's offered to any person going to take that initial action towards understanding their options and dedicating to a sensible plan.

Table of Contents

- – The Expanding Need for Financial Debt Forgiven...

- – Bankruptcy Counseling: The Misunderstood Safeg...

- – Comparing Your Debt Alleviation Options

- – What Establishes Nonprofit Therapy Apart

- – Indication of Predatory Financial Obligation R...

- – Taking the Initial Step Toward Recuperation

- – The Path Forward

Latest Posts

The 7-Second Trick For Prevalent Misconceptions About How Nonprofit Credit Counseling Agencies Get Paid

A Biased View of Inflation and Increased Need Are Seeking Debt Forgiveness

Some Ideas on Immediate Impact on Your Credit Rating You Should Know

More

Latest Posts

The 7-Second Trick For Prevalent Misconceptions About How Nonprofit Credit Counseling Agencies Get Paid

A Biased View of Inflation and Increased Need Are Seeking Debt Forgiveness

Some Ideas on Immediate Impact on Your Credit Rating You Should Know